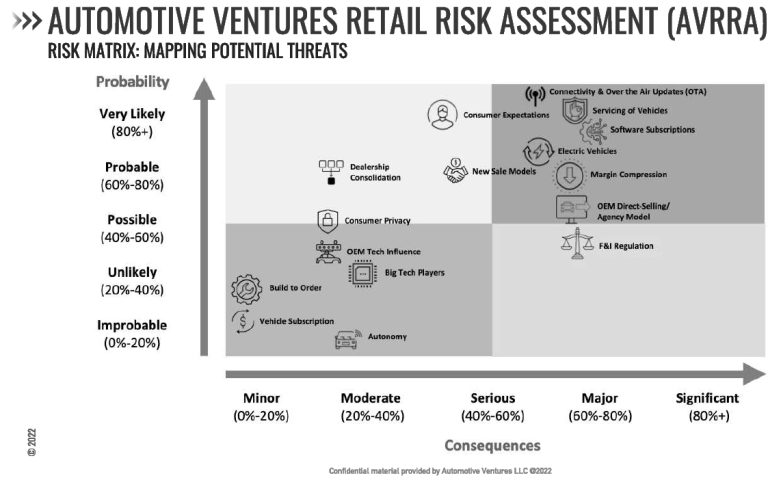

My new book, The Future of Automotive Retail, introduced the world to my Automotive Ventures Retail Risk Assessment (AVRRA). The assessment provides some great information regarding the trends that have the highest probability of coming to fruition and their potential impact on the automotive retailing industry.

The goal of the AVRRA is to be able to work closely with dealers to develop a roadmap for action in order to prepare for and neutralize some of the bigger threats exposed by the Risk Assessment. By monitoring these trends, dealers will be better informed and prepared for the future. Staying vigilant and on top of these themes will help industry players stay competitive and thrive in this accelerating period of change. The graphs included in this address a variety of disrupting trends in the industry. Below is an overview of some of the more significant potential trends:

Connectivity & Over-the-Air Updates: There is expected to be growing tension around who “owns” the customer — the OEM or the dealer. Over-the-Air (OTA) updates will mean a decrease in recalls; however, dealers may profit from connectivity through participation in connected services revenue as well as greater insights into consumer driving behaviors and increased transparency into maintenance needs.

Servicing of Vehicles: Electric Vehicles (EV) and OTA updates threaten to decrease both service and parts revenue. This may be offset by more sophisticated technicians and equipment and thus higher billable rates.

Software Subscriptions: Automakers are planning to diversify their revenue away from traditional volume sales and aftersales and move towards high-margin software-enabled subscription services. Examples could be unlocking additional horsepower, activating rear heated seats, and providing enhanced in-cabin experiences. These services will be paid for monthly and may or may not be activated after the sale of the vehicle. It is way too early to gauge how revenue from these services, much of which will be activated post-sale of the vehicle, will be shared between OEM and dealer.

Margin Compression: The internet has armed the online shopper with far more transparency around new and used car pricing and drove much of the margin out of the front end of the car deal. As inventory levels get back to normal, the industry should expect to get back to an environment of compressed margins.

Direct Sale/Agency Model: The “Agency Model” is an evolution away from a more typical franchised dealership model to “agents” who sell products on the OEM’s behalf. The Agency Model is attractive to the automakers because they see the potential to reduce operating costs, eliminate discounting, and normalize the customer experience. In a new role as “agents,” dealers receive a commission or handling fee for providing certain services. Dealers need to stay attuned to how this is playing out overseas, and the implications, as different OEMs take different approaches.

Consumer Privacy: A connected car can now collect 25 GB of data per hour. Data creates vulnerabilities. In parallel to vehicle data, there has been a recent trend toward consumer privacy laws and protections. More data collected means more “surface area” for hackers to penetrate systems. The question will be “Who is liable when consumer data is breached?” Dealers will have to comply with amended cybersecurity and IT guidance the Federal Trade Commission recently handed down, and there is a December 9 compliance deadline for dealerships to adopt its Safeguards Rule amendments.

Dealers who embrace a future filled with ambiguity and who believe that having access to early-stage technology startups and innovative entrepreneurs will be the companies that best weather these challenges.

Steve Greenfield is CEO and Founder of Atlanta-based Automotive Ventures. He can be reached at 470.223.0227 or, via email, at steve@automotiveventures.com.