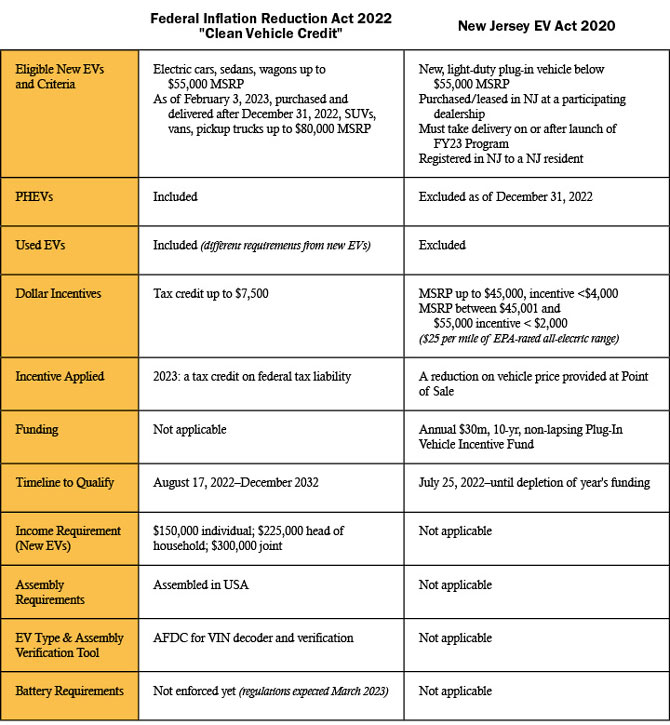

Navigating through the requirements for the federal and state-level electric vehicle (EV) incentive programs can be confusing for dealers and consumers. While both programs consider an EV’s MSRP, there are important variables for which they are not consistent. For example, the federal program provides a tax credit to reduce a consumer’s federal tax liability, is income-dependent, and applies only to certain makes and models based on where they were assembled and the source of materials and batteries. In contrast, the state program is a point-of-sale program and is not dependent on the factors relied upon in the federal program.

Frustratingly, the federal government seems to be creating the program while offering it (like making the plane while flying it). Since the enactment of the federal Inflation Reduction Act of 2022, with its Clean Vehicle Credit provision effective on August 17, 2022, dealers have had to struggle with confirming EV eligibility determinations and offering a less expansive pool of EV makes and models. In response to those struggles, the federal government took steps to address some of those concerns.

For example, to take the guesswork out of which EVs are eligible for inclusion in the federal program, the Department of Energy’s Alternative Fuels Data Center (AFDC) created a VIN Decoder and Verification webpage. To address the concern of OEMs that were deemed ineligible to be part of the federal program, because they reached the cap on their EV tax credits, the federal government recently allowed those OEMS into the program, retroactive to January 1, 2023. Guidance regarding sourced materials is expected later in 2023 and details about switching it to a point-of-sale program in 2024 are not available.

In contrast, and though not without its own challenges, the state’s program is not as complicated and is in its second year as a point-of-sale EV incentive.

Our members need to stay on top of the requirements for both programs. On the next page is a brief cheat sheet that lists 11 key areas to compare and contrast the two programs.

In addition, below are the websites for three important resources that every New Jersey dealer should have bookmarked for the federal program including:

1. The webpage for the AFDC VIN Decoder and Verification

https://afdc.energy.gov/laws/electric-vehicles-for-tax-credit

2. The webpage for the IRS’ determination of qualified OEMs under the retroactive guidelines

https://www.irs.gov/credits-deductions/manufacturers-and-models-for-new-qualified-clean-vehicles-purchased-in-2023-or-after

3. The webpage for the IRS’ FAQs

https://www.irs.gov/newsroom/irs-issues-guidance-and-updates-frequently-asked-questions-related-to-new-previously-owned-and-qualified-commercial-clean-vehicle-credits

Electric Vehicle Incentives