New Jersey residents may not be aware that franchised dealerships throughout the state play an important role in helping combat motor vehicle crimes. Some may be familiar with TV episodes of crime investigators approaching the private sector for help investigating a crime. In real life, the state’s 500-plus dealerships play an essential role in helping New Jersey State Police’s Motor Vehicle Crimes Unit (MVCNU).

Several years ago, MVCNU approached NJ CAR to establish a motor vehicle fraud information-sharing network. The Unit is a collaborative team comprised of New Jersey State Police detectives, the New Jersey Division of Criminal Justice, and officers from police departments in Paramus, Warren Township, Bernards Township, Westfield, Middletown and Clifton. Through NJ CAR to dealerships, the Unit disseminates information about fraud suspects who attempt to victimize dealerships with various car theft schemes. Once the information is provided to NJ CAR, it is immediately distributed to its franchised dealership members. Criminals consider this “vehicle finance fraud” to be low risk and easy because finding and linking the conduct to the suspect is complicated, and there may be a long reporting time before the fraud is discovered. The deception is usually detected once the financial entity realizes they haven’t received several payments or after they’re contacted by the identity theft victim who started receiving bills for vehicles they don’t own.

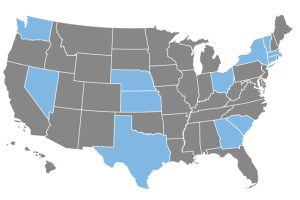

The partnership between the MVCNU and NJ CAR’s members creates a critical first step in locating the suspects in real time as they attempt their fraud. The motor vehicle crimes targeted by the partnership start when fraudsters present dealerships with stolen identification or credit cards of actual people to support the purchase or financing of new vehicles. Or, they present credentials they created of phantom people to trick dealerships and financial institutions. Through either technique, suspects seek to take possession of vehicles, then ship them to foreign countries where they become part of an illegal underground market to be resold. The targeted states for these efforts include New Jersey, New York, Connecticut, Pennsylvania, Ohio and Maryland, and sometimes the fraudulent transactions occur several times a day throughout various states.

The partnership between MVCNU and New Jersey new car dealerships has demonstrated that dealerships are incredibly useful in the fight against motor vehicle crimes. Once informed, they can alert the MVCNU when the suspects are in the dealerships and thus help law enforcement prevent the crime and track any ongoing efforts. According to the MVCNU, the following are examples of successful collaboration between franchised dealerships and law enforcement:

Incident #1

- A suspect attempted purchase in Somerset County but was denied based on an NJ CAR alert. The dealership contacted NJ CAR and the MVCNU.

- The suspect visited a dealer in Middlesex County and obtained a car using a stolen identity. The dealership contacted the MVCNU after seeing the NJ CAR alert.

- The suspect (and accomplices) were apprehended in a Monmouth County dealership after the dealership contacted the MVCNU while the individuals were in the dealership. This fraud ring was linked to seven suspects and 23 fraudulently purchased vehicles in New York, New Jersey, and Connecticut.

Incident #2

- A Burlington County dealership sold a Jeep Grand Cherokee on a Thursday to a suspect who used a stolen identity, wanted another car the following Monday, and sent a copy of a fictitious license.

- After seeing the NJ CAR alert, the dealership contacted the MVCNU.

- The suspect, who had been involved in over 20 dealer frauds in New Jersey, was apprehended at the dealership, along with another suspect involved in at least four scams. And, the MVCNU was able to recover the Jeep for the Burlington dealership.

Sometimes neighboring law enforcement agencies rely on New Jersey’s network to help track motor vehicle crime rings. As recently as Sept. 2021, Maryland law enforcement requested the assistance of NJ CAR’s members when they provided information about suspects who, using stolen identities online, were involved in a vehicle fraud ring related to the purchase of luxury vehicles in New Jersey, Virginia and Delaware.

Motor vehicle finance fraud prevention is a niche industry. Unlike other motor vehicle crimes, which concern the possession of a car, these specific crimes involve fraudulent purchases that trick dealerships and the finance industry. These crimes are different from the usual references to motor vehicle theft. In today’s day and age of internet sales and purchases, the facility of these types of financial auto thefts has become even more complex and difficult against which dealerships must guard. Through their efforts at the international, national, and state levels, law enforcement identifies “red flags” for motor vehicle fraud purchases, about which they then caution dealerships. In New Jersey, the MVCNU has presented training sessions for dealerships on “Trends and Tips to Avoid Becoming a Victim” and has made recommendations on best practices to prevent fraudulent purchases.

Magdalena Padilla is NJ CAR’s Director of Government Affairs. She can be reached at 609.883.5056 ext. 345 or via email at

mpadilla@njcar.org.